Summer bring slow economic numbers

Dog days of summer bring slow economic numbers

Dear Friends,

Once again, we have many numbers coming in, some are concerning while others are encouraging. Most recently, the consumer price index was flat from June to July. Overall prices are only up 0.8 percent in July from a year ago.

Election season economic effect

The Wall Street Journal recently surveyed economists and found that 57 percent of them believed that the presidential election is having a negative effect on the economy. The uncertainty is believed to effect business and individuals who have questions about regulations and taxes they will face with a new administration.

As I wrote in my last blog, business investments through June declined for the third straight quarter.

Retail sales were a surprise bummer

Expecting a small gain in retail sales, the number was flat going from June to July with the only bright spot being automotive sales gaining 1.1 percent. Compared with June 2015, total retail sales and core sales increased 2.3 percent and 3.8 percent, respectively.

Expecting a small gain in retail sales, the number was flat going from June to July with the only bright spot being automotive sales gaining 1.1 percent. Compared with June 2015, total retail sales and core sales increased 2.3 percent and 3.8 percent, respectively.

Shoppers cut back on discretionary spending creating doubt that the economy will see a growth burst in the third quarter.

June’s numbers were revised to +0.8 percent by the Commerce Department from a previously reported +0.6 percent. Year-over-year there was 2.3 percent growth.

Continuing brick and mortar store challenges

Macy’s joined the ranks of retailers announcing store closings as they said 100 stores would shut their doors. Those closings will represent 15 percent of its locations and 4 percent of revenue. These closures are in addition to the 40 announced earlier this year.

Other retailers hanging “closed for business” signs include:

- Sports Authority- 460 stores through bankruptcy liquidation

- Walmart-154 U.S. stores of 269 closures worldwide

- Aeropostale- 154 stores closing after a Chapter 11 filing

- Kmart/Sears- 78 Kmart and Sears stores after closing 50 earlier this year

- Ralph Lauren- at least 50 stores

As a rule, all retailers are seeking a better e-commerce strategy that leads us to the next noteworthy event.

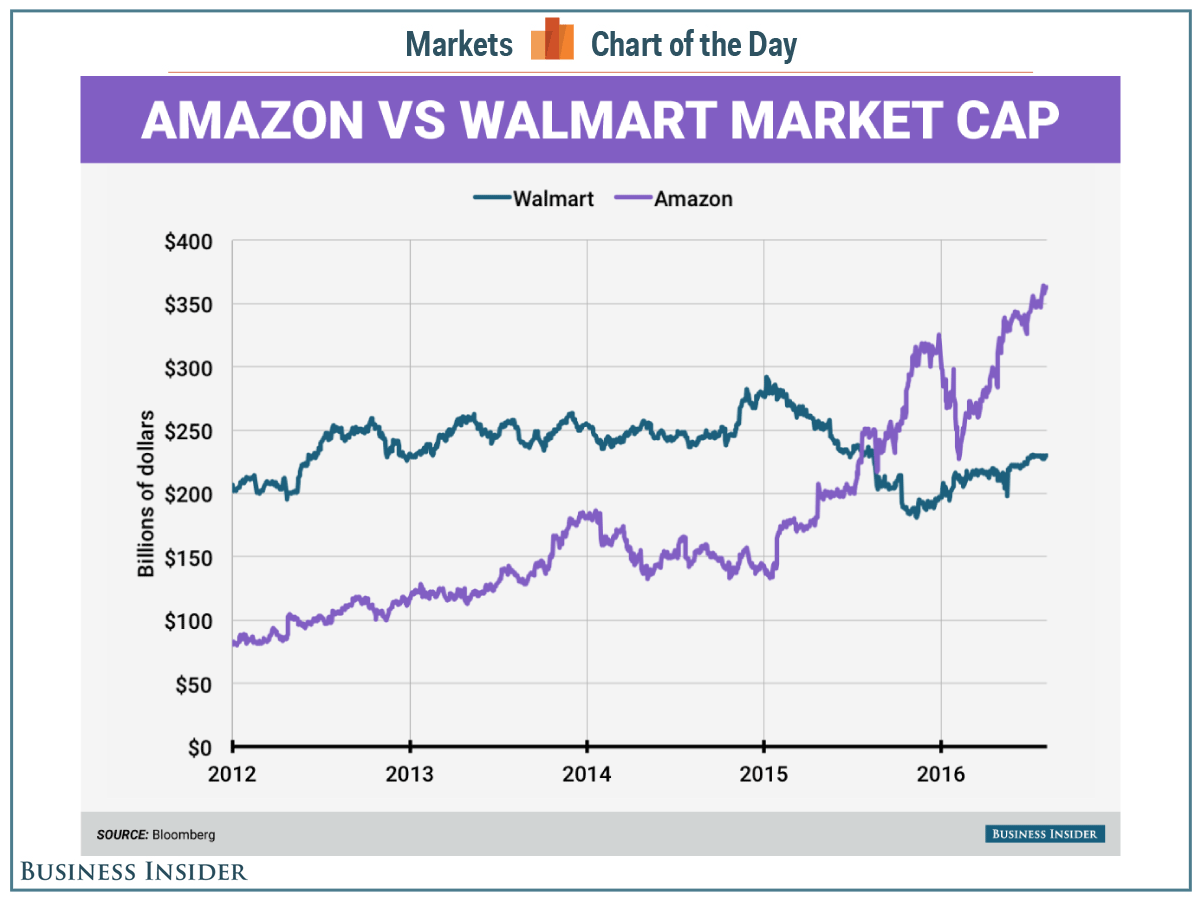

Jet.com acquired by Walmart

In an effort to take on the Amazon e-commerce behemoth Walmart is buyingJet.com for $3 billion in cash and $300,000,000 in stock. Jet.com has grown from scratch in one year to one billion dollars in sales and that caught the attention of the Bentonville crowd.

Jet.com has the website technology and Walmart has the buying power along with the distribution fulfillment talent and financial muscle to support the infrastructure for growth. This is a statement by Walmart that they are not conceding e-commerce to Amazon as they grow the Jet.com brand.

Worker productivity challenges

The long-term health of the U.S. economy is threatened by falling worker productivity as the most recent quarterly measure of non-farm businessproductivity fell at a 0.5 percent seasonally adjusted rate. The Labor Department defines non-farm business productivity as the goods and services produced each hour by American workers.

Productivity fell for the third quarter in a row and it is a troubling trend as significant growth in wages, benefits, pricing, and economic output simply cannot happen without dramatic improvements in worker productivity.

Growing wages without associated production gains will cut into business profits. Significant business investment in software, process improvement, facilities, and automation has to occur. I direct you back to my earlier comments about three straight quarters of weak business investment as a cause.

With average wages and income rising 2.6 percent for hourly workers in July year-over-year, the pressure is on business to fix this problem.

I am hopeful that after we get a clear direction from a new administration that we get answers on the regulatory environment and tax code so that businesses can get out their collective wallets and invest wisely for the future.

Truckers retrenching

The trucking industry showed confidence in growing demand by hiring 1,700 positions in July after cutting back on hiring last spring as indicators show a slight increase in freight activity by the end of the month. In the week ending August 6th, DAT Solutions reported the number of available loads on the spot truckload market fell 3.9 percent.

Refrigerated demand stayed flat as the national spot rate for reefers remained at $1.93 per mile while load posting increased 4 percent.

Dry van posts for loads fell 2 percent while supply held steady. The load-to-truck ratio dropped 2 percent to 2.7 loads available for each truck. The national average spot rate for vans remained unchanged at $1.64 per mile.

Loads out of Chicago gained five cents/mile, Columbus outbound picked up two cents to $1.81, and Memphis outbound ticked up 3 cents to $1.87 per mile, for positive rate movement in several lanes.

In the week ending August 6th Truckstop.com Market Demand Index (MDI) decreased 8.7 percent this week from last week to 12.53. The MDI had increased 7.3 percent the week before.

The MDI is tracking below the five-year moving average. Index values below 7.0 tells us that the market favors shippers and brokers over truckers in negotiations so the carriers still have some negotiating power.

Slow going on the railroad

The Intermodal Association of North America (IANA) reported that intermodal shipments fell 6.1 percent in the second quarter from the year earlier ending a streak of 25 consecutive quarterly increases.

Domestic container freight increased 3.4 percent while international loads fell 9.3 percent. Domestic trailer freight fell 29 percent due to a slow freight market and diversions to truckload.

It did not help that Norfolk Southern cut back on its Triple Crown network.

For the week ending August 6th, overall total unit volume for commodity carloads fell .5 percent from the week before. Year-over-year, carloads were down 1.6 percent for the week.

Grain loads are on the rise but oil and coal continue at their depressed levels as many power plants convert to natural gas.

At Wagner Logistics

Wagner’s seasonal business has started and projects are underway. Display pallet production has begun and we are excited about the next few months leading up to Black Friday.

Many thanks to our HR and IT group who has our new Charlotte, NC facility heading for an early September startup. I also want thank our Executive Team for concluding negotiations for the space we will occupy in Memphis and doing a fine project plan for an October start.

The IT team has had their hands full as we have implemented our new WMS in Edgerton, KS and are in process at our Pine Bluff, AR facility. Between the two facilities, its one million two hundred thousand square feet of RF coverage completed no small task.

Should you have a distribution center project in mind or planning a transportation RFP, I hope you will give us a call. With 70 years of business experience behind us, we say “Bring It” every day!

Have a great day,

John Wagner Jr.

About Wagner Logistics

Wagner Logistics is a leading supply chain management provider offering distribution center, fulfillment and transportation services across the United States. Current offices include Kalamazoo MI, Charlotte NC, Jacksonville FL, Cleveland OH, Pine Bluff AR, Omaha NE, Dallas TX, Clinton IA, Kansas City MO and KS. Wagner combines high-tech tools with high-touch product pampering to ensure that inventory is where it needs to be, when it’s needed, in the condition customers expect. From product displays to complex fulfillment to vertical supply chains for fragile products, we want to tackle your biggest challenges. Bring it!

Have a great day,

John Wagner Jr.

About Wagner Logistics

Wagner Logistics has been honored 15 years in a row by Inbound Logistics as a Top 100 3PL provider, we offer dedicated warehousing, transportation management, packaging and assembly operations across the United States with over 3,000,000 sq. ft. Current offices include Jacksonville FL, Cleveland OH, Pine Bluff AR, Dallas, TX, Omaha, NE, Clinton, IA, Kalamazoo, MI, Edgerton, KS, and Kansas City MO and KS. We provide genuine customer service to our customers and our superior onboarding process will make your customer’s transition seamless. We work tirelessly to find innovative solutions to reduce supply chain costs while increasing your speed-to-market with our award winning technology.