Automation in the supply chain to get major boost in 2019

Warehouse automation and sensor technologies key focuses for investment heading into 2019

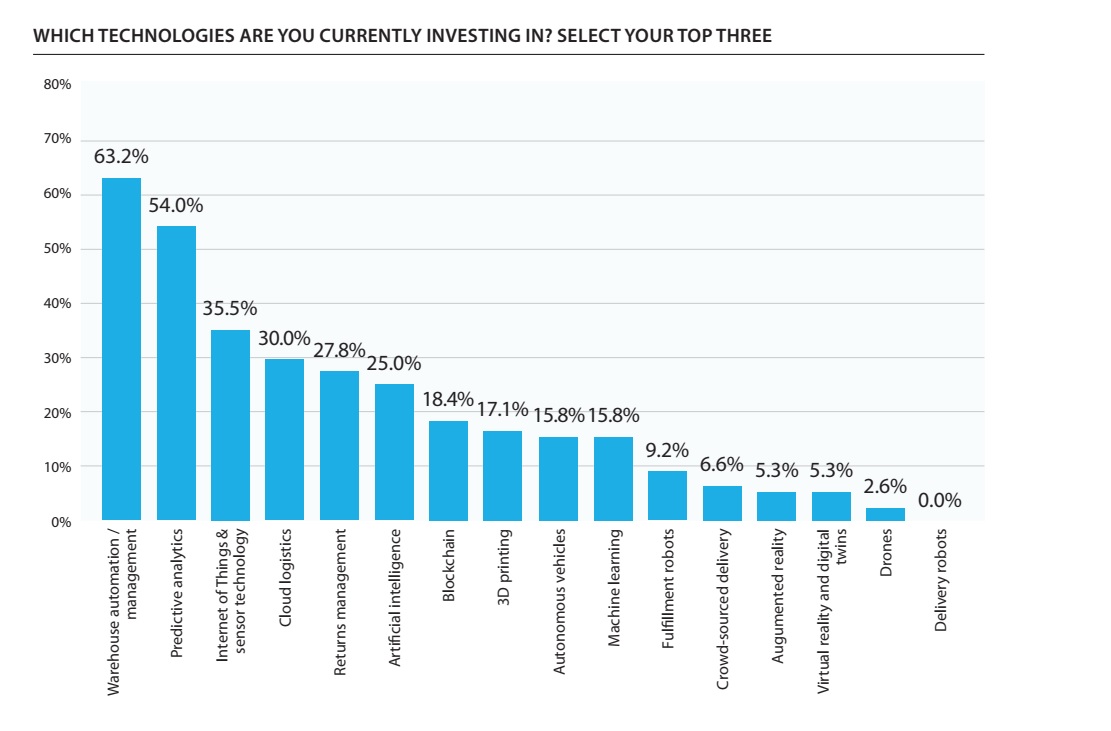

A new report and industry survey from eyefortransport finds that automation is the top investment priority for retailers and manufacturers in 2019, particularly within the warehouse. The drive to get goods to customers at speed and to achieve operational efficiencies in what is currently a very tight labour market is pushing the investment environment to strongly focus on making more efficient warehousing operations that incorporate automation throughout. Warehouse automation was rated the top investment priority in the survey, with 63.2% selecting it as a key area of focus. This was followed by predictive analytics (54%) and the Internet of Things (IoT), which was a major growth area in this year’s results. It grew as an area of investment from being selected by 12.9% of retail and manufacturing respondents in 2017 to 35.5% in 2018.

With warehouse automation also on the up from 40.6% in 2016 to 63.2% in 2018 and return management growing from being selected by 18.8% to 27.8% across the same period, it is clear from this year’s results that the focus is on making a lean warehouse that can track inventory and handle returns more effectively.

Exactly half of respondents said that automating aspects of their supply chain was either an immediate or an advanced priority. This was followed in terms of immediate or advanced priority by investing in visibility, at 36.1% of retailer and manufacturers. Investing in forecasting and purchasing warehouse space have diminished as priorities since 2016 and 2017 results.

These trends reflect the huge growth in e-commerce trade with its added complexity over traditional retailing, as retailers must now work across more than just the nodes of distribution that are their stores, and instead to thousands or millions of individual consumers, each with their own requirements and product preferences.

“Pretty much every company is using more robots in auto-filling and sticking them into their distribution services,” says Himanshu Rautela, currently on sabbatical at MIT from his role as Senior Manager, Supply Chain Planning at Walmart. “[This] can not only lower the cost of managing the warehouse, but it can also streamline processes and reduce the margin of error.”

“One of the really key ones that we invested in a few years ago is we used Kiva robotics in our largest warehouse and what our focus has been on entirely is reducing manual labour, specifically related to picking in distribution centres,” says Gabi Weisel, Director, Global Indirect Procurement, Supply Chain for the Estée Lauder Companies. He notes that it has become more business critical “because of the difficulty in terms of keeping warehouse labour and retaining the warehouse labour”, an issue that has become more important as “e-commerce is increasing faster, with way more picking happening. Even on the retail side for us, the orders are smaller than they used to be, so even for those types of orders we need more picking and manual labour required than we used to.”

To find out more about the state of retail in 2019, download the free report now. This exclusive report features:

- An industry survey focused on retailers, e-tailers, brands and manufacturers that throws light onto the major trends emerging in 2019.

- Analysis that helps you understand what is happening and why the landscape is changing.

- Interviews with multiple supply chain experts from multiple angles.

- More than 20 charts and graphics explaining clearly key areas of investment, major challenges and where the supply chain is being transformed most.

Experts featured in the report include:

- Tobias Schulz, Senior Business Consultant, Quintiq

- Himanshu Rautela, Senior Manager, Supply Chain Planning, Walmart

- Gabi Weisel, Director Global Indirect Procurement, Estée Lauder

- Brad Smith, COO, Jack Grace

- Ryan White, Director of Freight Initiatives, New York City Economic Development Corporation